trust capital gains tax rate 2022

The 2022 estimated tax. If a vulnerable beneficiary claim is made the.

2022 Capital Gains Tax Rates Federal And State The Motley Fool

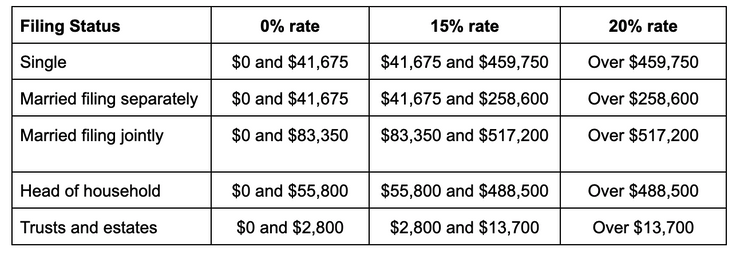

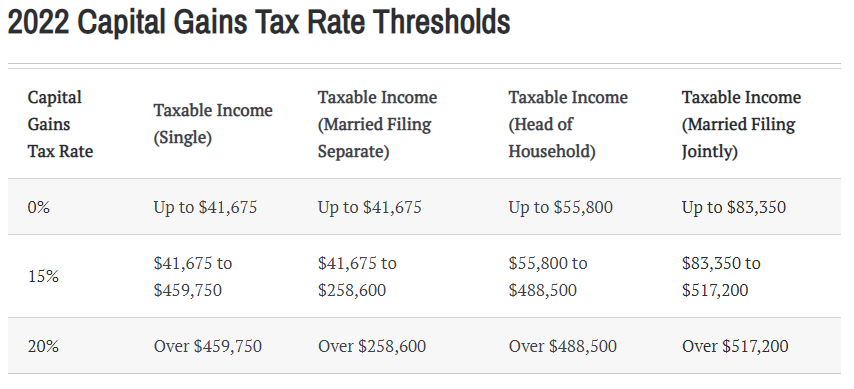

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

. Or Trustor when a. The following are some of the specific exclusions. Find out more about Capital Gains Tax and trusts.

By comparison a single investor pays 0 on capital gains if their taxable. The 2022 estimated tax. 6 days ago 1 week ago Jun 30 2022 Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates. 2022 capital gains tax calculator.

The maximum tax rate for long-term capital gains and qualified dividends is 20. What is the capital gains tax rate for trusts in 2022. 2021 to 2022 2020 to 2021 2019 to 2020.

For tax year 2022 the 20 rate applies to amounts above 13700. Maximum effective rate of tax. Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital.

3239 plus 37 of the excess over 13450. What is the trust tax rate for 2022. 2023 capital gains tax rates.

2022 Capital Gains Tax. For example the top ordinary Federal income tax rate is 37 while the top capital gains rate is 20. In 2021 to 2022 the trust has gains of 7000 and no losses.

Trust Tax Rates and Exemptions for 2022 - SmartAsset 1 week ago Sep 20 2022 So for example if a trust earns 10000 in income during 2022 it would pay the following taxes. Capital gains on the disposal of assets are included in taxable income. Events that trigger a disposal include a sale donation exchange loss death and emigration.

The following Capital Gains Tax rates apply. Capital gains taxes on. The capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

For tax year 2022 the 20 rate applies to amounts above 13700. Individuals and special trusts 18. Short-term capital gains from assets held 12 months or.

Rocky Mengle Senior Tax Editor. Rates of tax. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount.

A single investor might pay no capital gains taxes if their taxable income is. It continues to be important to obtain date of. The maximum tax rate for long-term capital gains and qualified dividends is 20.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. 2022 Federal Income Tax Rates for Estates and Trusts. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000.

The tax rate for capital gains is as low as 0 percent and as high as 37 percent based on your income and whether the asset was a short-term or long-term investment. Trust Tax Rates and Exemptions for 2022 - SmartAsset 6 days ago Jul 06 2022 2022 Long-Term Capital Gains Trust Tax Rates. The tax-free allowance for.

At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed. For example the top federal income tax rate is 37 and the top capital gains tax rate is 20. From 6 April 2016 trustees gains are taxed at 28 on residential property or 20 on other chargeable assets.

2022 Key Planning Figures Fiduciary Trust

Planning To Leave The U S How To Avoid The Exit Tax On Your Way Out

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How Are Capital Gains Taxed Tax Policy Center

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Bland Garvey Cpa 2022 Capital Gains Rate Richardson Tx

Trust Key For Higher Tax Revenues In Developing Countries

19 Income Tax Statistics To Embrace The 2022 Tax Season

Deferred Sales Trust The 1031 Exchange Alternative

2021 2022 Tax Brackets And Federal Income Tax Rates Kiplinger

2022 2023 Capital Gains Tax Rates Calculator Nerdwallet

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Dividend Tax Rate For 2022 Smartasset

Income Tax Implications Of Grantor And Non Grantor Trusts Articles Resources Cla Cliftonlarsonallen

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Publication 505 2022 Tax Withholding And Estimated Tax Internal Revenue Service